UNIQA Implements Remote Appraiser

In the last few months, we’ve been working hard with customers, implementing the Remote Appraiser.

Some like a light and quick standalone deployment, while others prefer to connect their CRM, CORE and document management systems from the start.

All these scenarios are perfectly fine, because we’ve built the Remote Appraiser in a way that makes it easy for insurers to deal with hard IT project choices.

It’s OK to pace digitalization of key services in a way that moves fast but doesn’t break things.

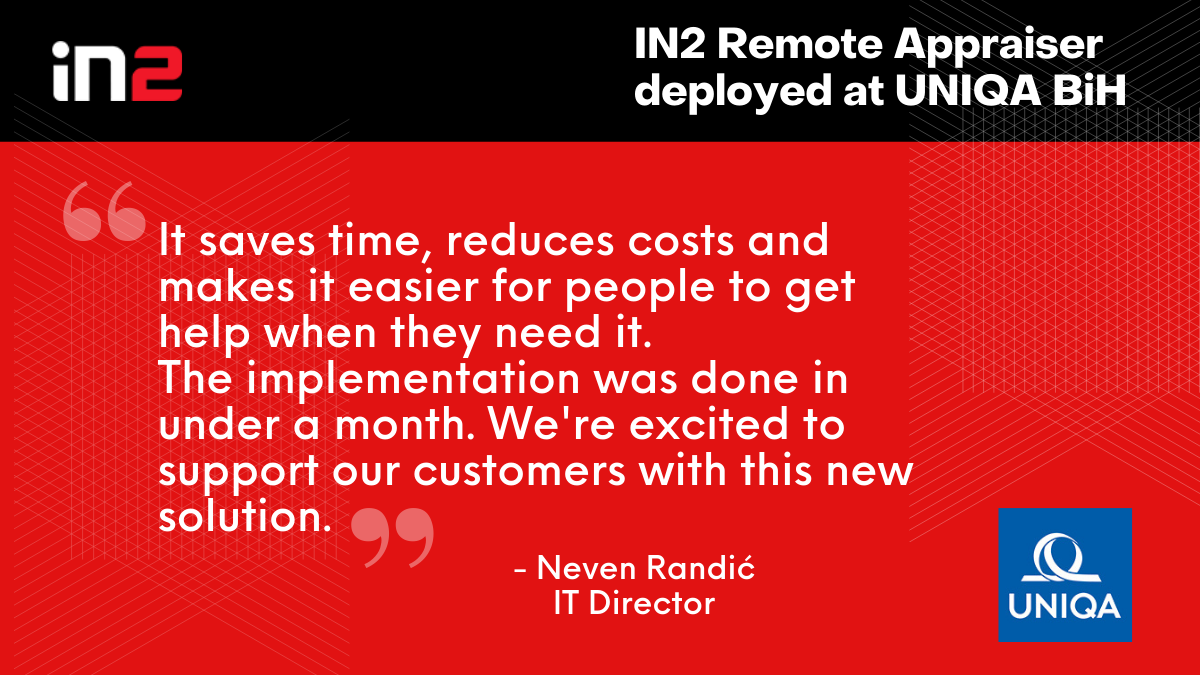

Here’s one example – UNIQU BiH, where we’ve rolled out the solution this week.

Making damage appraisals remotely is a good option in many situations, especially during pandemic. UNIQA decided to provide this option to their appraisers with the IN2 Remote Appraiser app, as a standalone option. The implementation was done in under a month. Their team was onboarded and finds the experience intuitive.

It saves time, reduces costs and makes it easier on customers to get help when they need it. We're excited to support our customers with this new solution.

— Neven Randić, IT Director

We’re excited about that too.

Because they chose the standalone approach, a month later they now have a pandemic proof way of appraising a large number of claimed damages remotely.

Learn more about INsurance2 Remote Appraiser and book a live demo call.